I can’t recommend Debt: The First 5,000 Years highly enough. I think it’ll give you insights into just how money works if you don’t already know that at a deep level. Being a geek, being college-educated I had no clue if you have an engineering degree or even a PhD in engineering, this isn’t necessarily something that you learn about.

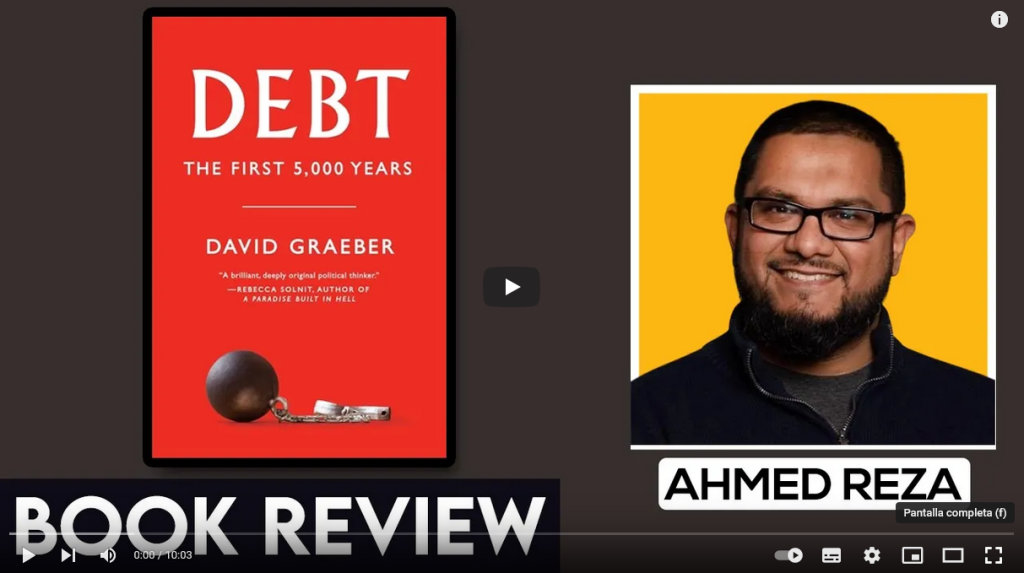

Hi! It’s Ahmed and I am back at the mountain top. I apologize in advance for the video quality, I’m just holding the phone with my hand this time. I’ve been coming up here for a couple of days and it is an absolutely gorgeous California day today. It’s going soon so I thought, hey why not post up another book review? I’ve been reflecting quite a bit on just the state of the world, state of business and I’ve been thinking particularly a lot about debt, what debt means.

And I wanted to discuss one of the most instrumental books in my career I can get in business is Debt: The First Five Thousand Years by David Graeber. It’s an incredible book, it is very insightful, it’s a very thick book and I’d like to start it off with a little bit of a story a friend of mine, Keith Donald. He’s one of the cofounders of SpringSource, a brilliant guy the kind of guy that I want to be like. Just a wonderful person he’s been an advisor and he’s had a successful career as an engineer, as an accidental entrepreneur. I’ll say as he doesn’t look like the seemly got Pharrell type he’s a philanthropist and I met him Trump of event and he’s just been an amazing individual to even know and he started this thing called Steadytown, which helps rehouse homeless people and there was a homelessness problem in Melbourne, Florida. Of course, compared to the Bay Area that’s like what homelessness problem the barrier is serious homelessness issues.

In Melbourne Florida he was doing as much as he could to rehab most people especially those who were homeless to financial issues like the lawsuit sometimes. I got a speeding ticket that threw all their finances off flax so I’ve been thinking a lot about Keith and he’s the one who turned me on to the book. I remember Keith telling me there was a model who’s working at McDonald’s. I’ve been taking care of her kids pretty well and got a red light ticket and that ticket God finds because she couldn’t pay it and eventually the mom and her kids were living out of the van because you know I just threw them completely off. And this time when there are 16 million unemployed people right now and probably going to get worse and most Americans don’t have a really good nest egg, most Americans are probably going to be able to relate to stories like that. And Keith was taking pretty innovative was taking a pretty innovative approach as a philanthropist. He tried to help solve a problem, he wasn’t focused on substance abuse, it was mainly just financial.

I want to give a quick shout out to my friend Jason Young of Mindblown Labs. He is another inspiration. Jason has been working on financial literacy for youth, from disadvantaged backgrounds people like me. He actually I grew up in the ghetto in New York and not very financially aware made a lot of stupid financial decisions including a Rolls Royce. I do not recommend that to anybody and right now if you have one, I am sorry for you.

So anyways back to the book. Keith tells me one time “do you really understand how debt works? How all banks work? How money works?” and up until that point I’d accepted that money was this valuable thing. I put a lot of morality into debt and that’s what we all think you know, we owe a debt of gratitude to someone we owe a debt to – our parents, the good people pay their debts and yeah there’s a moral aspect to it But debt as it is today is a very different thing. I’ve been seeing a lot of these talking heads on TV talk about “oh now we have so much national debt two trillion dollars, how are we ever going to pay it back?” and I realize how much financial illiteracy there is even amongst people who are leading departments like the SBA possibly. Recently there was the 2.2 trillion dollar stimulus package that was passed by the Trump administration and this is the one time I think politicians actually moved very fast and ended up getting hampered by politicians because the infrastructure at unemployment offices, the small business administration just wasn’t ready. And I feel like there’s also the lack of knowledge about how the financial system works. The SBA for example, gave what seemed to most people like a generous offer where they were like “hey we’ll get $10,000 into the hands of every business, we’ll figure it out later” but that actually was a good economic policy choice and then they freaked out. And they were like “oh my god we’re gonna call it a thirty year-old loan”, which is on the complete opposite end of the spectrum. And you can tell no offense to whoever created it actually, yeah offensive meant to whoever created it that person was an idiot. They had no idea about how like finances actually work at a macro level. Had they read Debt: The First 5,000 Years they would have understand how money works.

We live in a world where the US dollar is a fiat currency. It is not tied to the gold standard and a lot of people talk about “I’ll bring back the gold standard” but really take a deep hard look at what money is. How it’s created, how debt causes money to exist and debt for you and me for say like a car or a house is very different from the national debt. I one of the most memorable lines from the book is if you owe $400,000 on your house. Of the bank owns here if you offer hundred million dollars to the bank you own the bank. I’m not going to give you the answer as to why that is, you’ll have to read the book or you’ll have to listen to it like I did. It’s a pretty long book but it is so worth listening to or reading especially at a time like this when so many people have these misconceptions about what debt is at a macro level, at a national level.

So am I worried about the national debt? Sure, but not as much as I am worried about the debt that people have that people owed to credit cards; not as much as I am worried about student debt. And the student debt – national debt are very different things. Many people are saying “oh you know the United States can just print money” and “you know this is going to devalue the currency”. I couldn’t understand, I was worried about that as well with the six trillion dollars that’s going to get injected but really economics is a little bit more complicated than that especially the modern economy. If you happen to be an entrepreneur, if you happen to be in business, or even if you’re just a layperson who finds himself having more time and wants to understand how this whole money game works, I can’t recommend this book highly enough. It will blow your mind.You will sound like you’re a conspiracy theorist. And mind you the author is probably viewed with some degree of skepticism by the academic community but heck it’s that’s a good place to be I think. So if you go through the book you are going to learn about things like “fractional reserve banking”. I also realized that hey if you literally wanted to be in the money making business your bank if it looked at how to start a bank. I think my friend Keith actually tried starting a bank and doesn’t realize is very very highly regulated. There’s a lot of things involved right? A lot of laws and honestly right now I am so glad I’m not a bank. Although props to all the banks that are helping people. There are a lot of community banks that have stepped up. I feel for all of the employees of the bigger banks who are under tremendous amount of stress because these are all people they feel a moral obligation to help and they’re doing the best that they can.

Again, I can’t recommend Debt: The First 5,000 Years highly enough. I think it’ll give you insights into just how money works if you don’t already know that at a deep level. Being a geek, being college-educated I had no clue if you have an engineering degree or even a PhD in engineering, this isn’t necessarily something that you learn about. So I highly recommend it to my fellow geeks, my fellow founders and just anyone in general so that you have a little bit more knowledge of what’s going on. You know can’t really predict the future at this point but you can try. Thank you.